What is Personal Capital? 2019 Review Including How We Use it to Manage Money

Whether you’re first starting with investing or are a seasoned trader, Personal Capital has something for everyone. Here’s a look at the tools it offers to help you track and manage your money.

Robo-advisors have grown in popularity in recent years as the stock market has risen, and digital commerce has continued to improve. One of the first Robo-advisors, Personal Capital, was founded in 2009, although it didn’t get its official start for another two years.

Personal Capital, our favorite free online finance tool, offers two main financial products. First, there’s the core product, an online personal dashboard that’s open to anyone and includes free investment tools and analyzers. The company also offers a wealth management product for clients with balances of $100,000 or more. For this, the company charges a maximum of 0.89 percent per year for assets under its management.

Whether you’re first starting with investing or are a seasoned trader looking to take your portfolio in a new direction, Personal Capital has something for everyone, as you’ll learn below.

What is Personal Capital?

I’ve been using Personal Capital’s core product for a few years through both the company’s website and iOS app. Most of the article focuses on this aspect of the business, although I will briefly discuss its wealth management offerings too.

Online Personal Dashboard

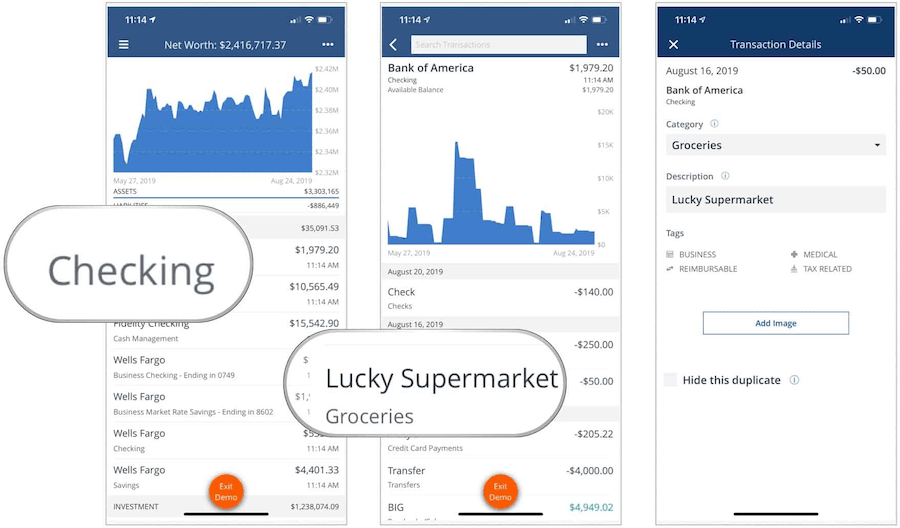

Personal Capital’s free financial tools take many forms. These include a retirement planner and fee analyzer, investment checkup, savings planner, and budgeting and cash flow guide. To get started, you must authenticate your online banking accounts using the usernames and passwords provided by each source. The more accounts you add, the better and more accurate an analysis Personal Capital can provide using its built-in algorithms. Ideally, you should add your checking and savings accounts, IRAs and retirement portfolios, and information on mortgages and loans.

Once you’ve added your accounts, the Personal Capital dashboard offers a real-time view so you can track and manage your entire financial life and net worth. Information about your accounts are updated once every night, and then each time you log into the application, up to once every four hours.

Adding accounts to the dashboard is a simple process. I’ve noticed, however, that logging into some accounts for the first time took a few attempts. Once completing the initial authentication, however, syncing works as promised moving forward.

Transactions

As synced account transactions get added, you can adjust them by adding categories and descriptions. You can also add tags and images. Moving forward, Personal Capital uses this information to provide better insight and to match future transactions for record-keeping. For example, if you categorize Target transactions as Groceries, future transactions will also include that distinction. Put together, this type of information is used to provide budgeting and cash flow information and insight.

What About Security?

Data entered is encrypted using AES-256 with multi-layer key management, including rotating user-specific keys and salts. Before accessing your information on another device, you must first authenticate using an automated phone call, email, or SMS. For extra mobile protection, you can use Touch ID or Face ID on iOS devices and mobile-only PINs on Android. Additionally, unlike other free online personal finance tools, Personal Capital has rock-solid terms of service. In other words, they don’t make a lot of cash selling your data to other services because its primary goal is to one day win you over and up-sell you to use its wealth management service. Personally, however, I’ve been using the free tools for over three years and have no plans to use it’s other paid plans. Just something to keep in mind as you weigh PC vs. other free online tools.

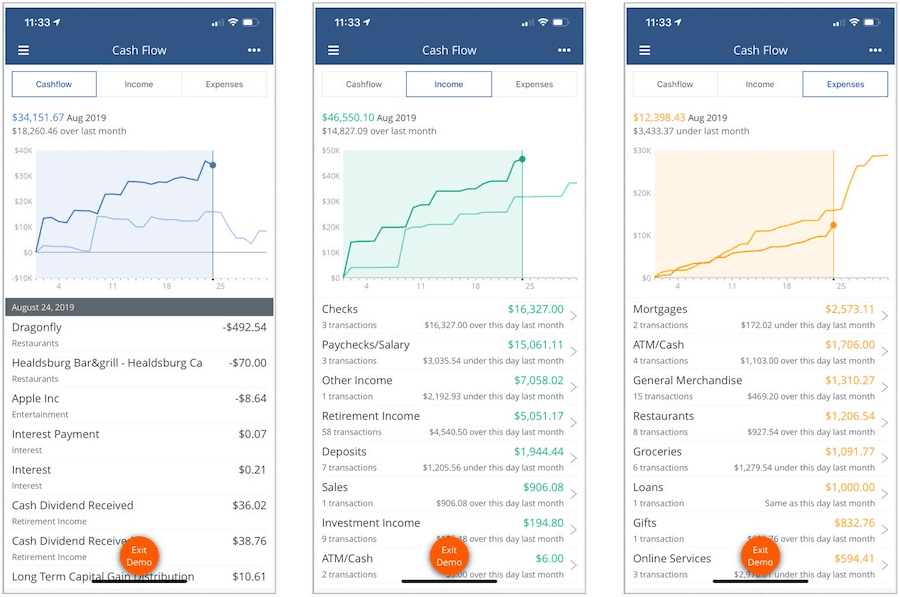

Cash Flow and Budgeting

Under Cash Flow, you’ll see a breakdown of where your money is coming from and how it’s being spent by category. You’ll also see how both income and expenses compare to the month before. Drilling down are transactions for each group. Budgeting breaks down all of your monthly payments by type and allows you to filter by account. You can adjust descriptions and categories for each transaction with ease either on the web or through the Personal Capital app. As a bonus, you can also link your credit cards, loans, and mortgage accounts to see your bills, although that functionality is limited to the web only.

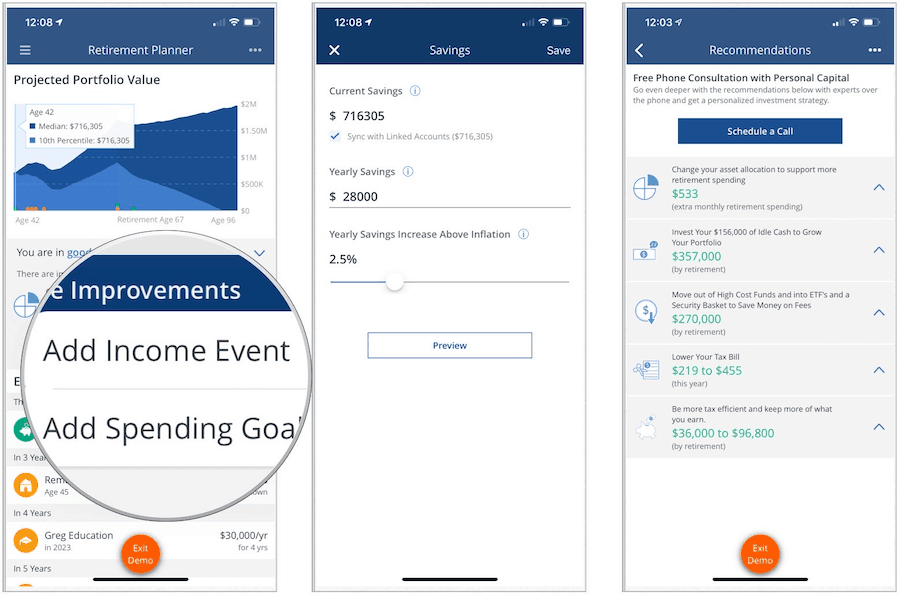

Retirement Planner

With the built-in retirement planner, Personal Capital offers insight into whether you will have enough resources at a later date. To provide this assessment, the algorithms using your real-time account information plus projected income and spending goals.

For example, you may want to see what buying a new vehicle or vacation home might do to your plans, or how receiving an inheritance might change your future living income. The planner uses this information to provide further insight such as whether you might face higher taxes if a particular situation occurs or there is an economic slowdown. This insight changes often based on your current account information and goals. There’s also a retirement fee calculator that shows you what you’re likely to spend until retirement on the servicing of your retirement funds.

Are you looking for more? Personal Capital also provides a free phone consultation to help you create a personalized investment strategy.

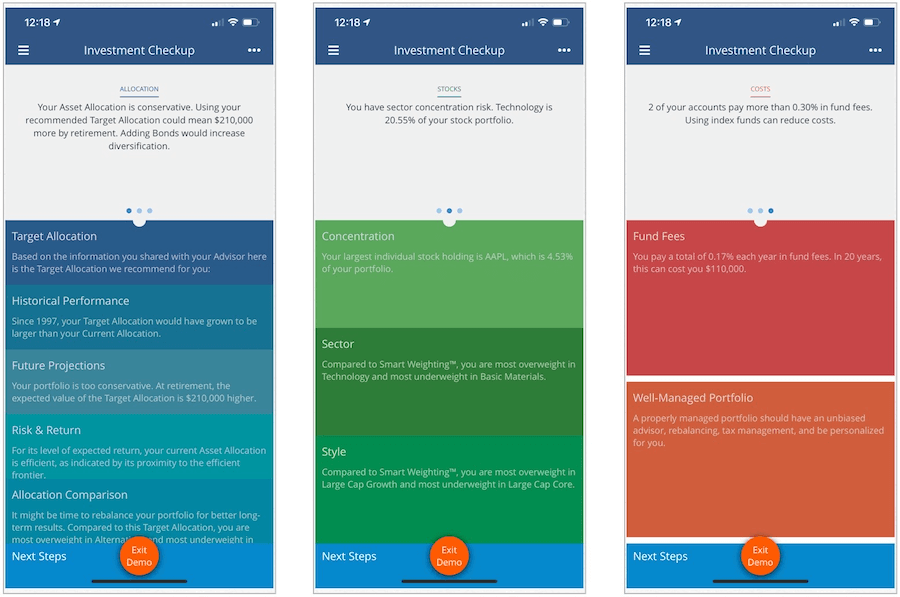

Investment Checkup

With the Personal Capital investment checkup tool, you can get a better idea whether you’re investing in the correct asset classes and companies based on your age, risk aversion, future allocations, and historical data. It also shines a light on the fees you’re spending yearly on your investment accounts and how those fees will multiple in the years ahead. Personal Capital suggests targeted allocations for your investments moving forward.

Savings Planner

No one likes to have liabilities, but it’s part of life. With obligations comes the costs associated with holding debt. With the Personal Capital’s Savings Planner, you’ll have a better idea of how long it will take to pay down your debt and at what cost. The planner also includes an emergency fund tool, so you know how much to save to get past unplanned events such as layoffs.

Personal Capital’s Savings Planner is only available on the web.

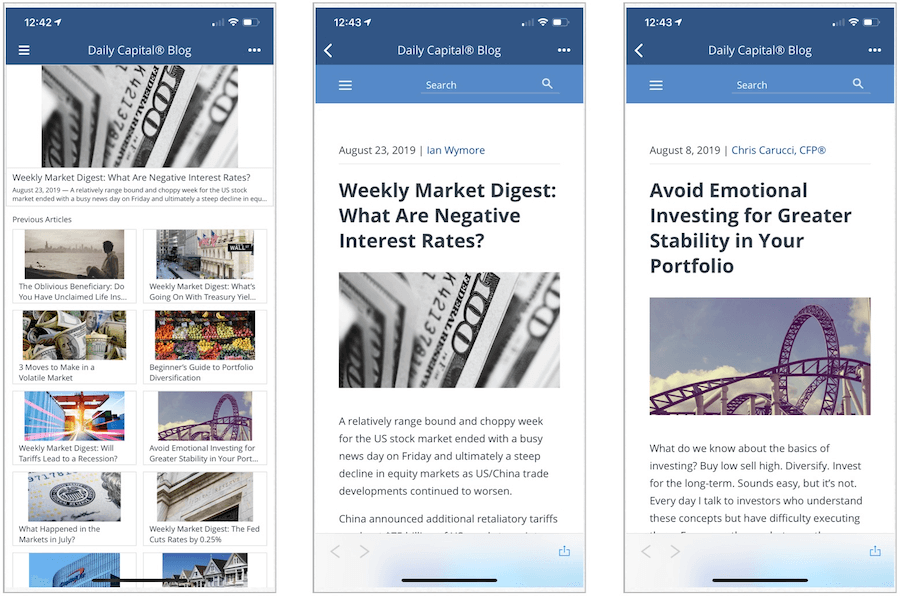

Daily Capital Blog

As a free Personal Capital user, you also gain access to the company’s Daily Capital Blog. From here, you can access free articles on the latest financial news, from Wall Street to Main Street. The list of articles continues to grow with new content posted each week. It’s another helpful tool to have to help you better manage your money.

Wealth Management

For those with $100,000 or more available to invest, Personal Capital offers additional services including a wealth management program. Services include access to members of the company’s financial advisory team, 401k advice, 24/7 call access, and support priority services. The company also provides tax and education planning, and much more.

If you allow Personal Capital to manage your money, it charges 0.89 percent on the first $1 million. That percentage drops to as low as 0.49 percent on funds of $10 million or more. To date, Personal Capital has over $10 billion in assets under management.

The Bottom Line

Financial experts who have reviewed Personal Capital’s wealth management solutions have given the company mostly high marks, although many have criticized the company for its $100,000 account minimum. The company has received mostly praise for the free tools it offers to anyone with a computer or mobile device.

Nerd Wallet says, “Personal Capital’s fees are on the higher end, but anyone can use the robust free tools.”

Over at Investor Junkie, there’s only praise: “A free and easy-to-use personal finance software that syncs up all your accounts in one location. Personal Capital creates summaries of your spending, net worth, and most importantly, your investment portfolio. The up-sell is its wealth management service.”

Finally, Money Under 30 explains: “Get Wall Street-level investment insight and supercharge your returns with this powerful (and free) app.”

I plan to continue using Personal Capital’s dashboard in the months and years ahead. In time, I might even consider letting it invest some of my retirement money. My experience so far has been nothing short of positive with both the Personal Capital app and website. Both together have become my favorite financial management tool. Both are easy to use, informative, and yes, useful. I can’t wait to see where the company heads going forward.

For more information on Personal Capital, visit its website.

Leave a Reply

Leave a Reply